Why Gold? – July 2020 Update

07th August 2020

Thank you for your patience

07th August 2020

Why Gold?

By Saftar Sarwar – Chief Investment Officer. Binary Capital Investment Management.

Our investment philosophy is long-term and conviction led. We research, analyse, question, and monitor our positions on many many levels, resulting in the high conviction we have on our investment solutions. We believe in our investment ideas and are happy to articulate to whomever necessary.

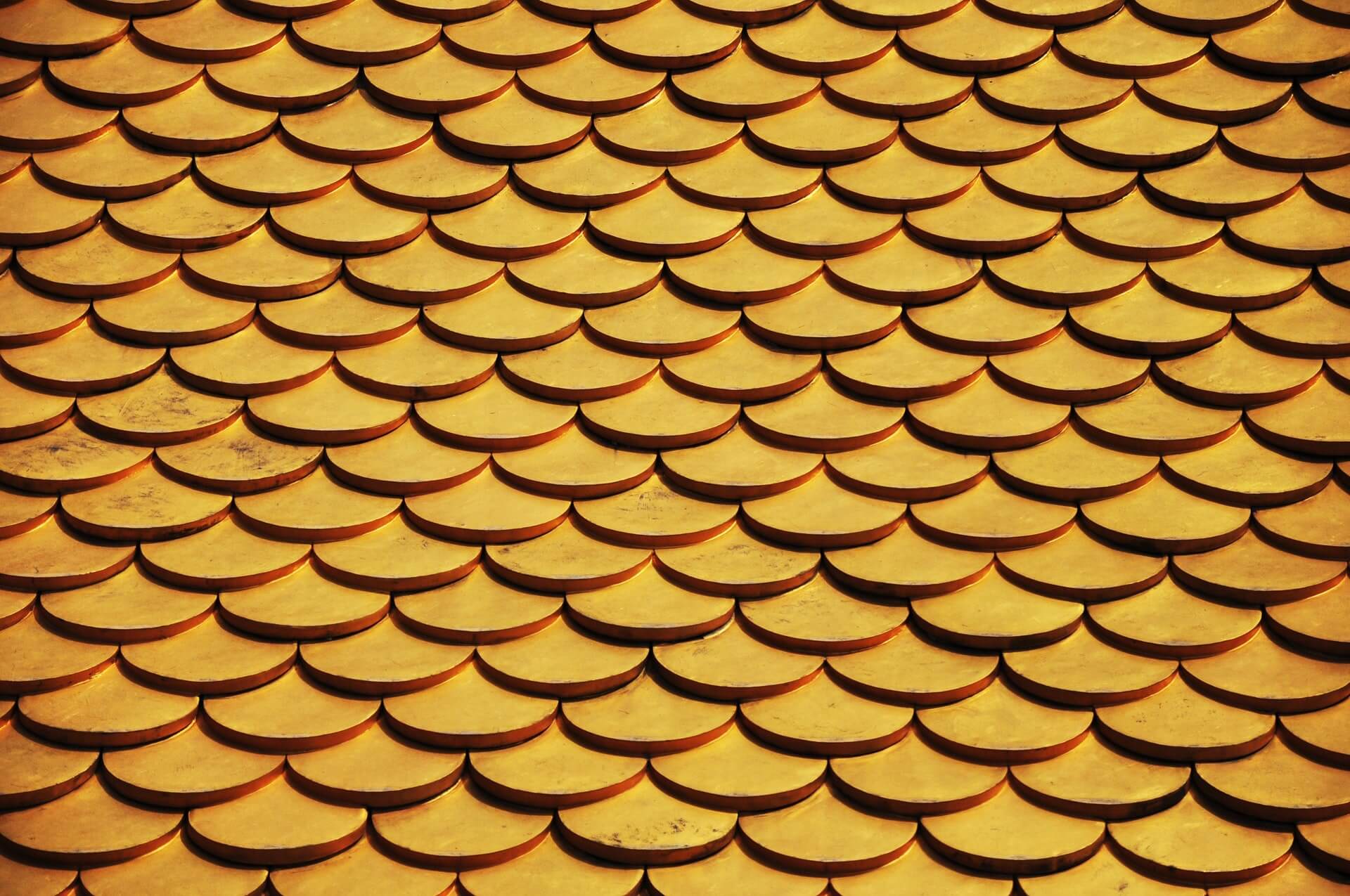

One such conviction position has been Gold. We do not invest in Gold from a philosophical viewpoint, but from an opportunistic, liquidity, and risk management perspective. We view Gold as any other asset class, one which we can utilise as and when we need to do so. We are not fixated on Gold in any other manner but to seek returns for clients.

At the end of 2019 we became increasingly concerned around the level of equity market returns and valuations within many such markets, particularly western equity markets. This was against a background of a synchoronised global economic slowdown. How could we mitigate and manage risk without over-complicating matters? Sticking to our principles of investing in long-only, liquid, and transparent regulated investment instruments.

One way that covers the above is to take a position in Gold. Gold in uncertain times has often been seen as a safe haven allocation as investors move out of riskier assets. Gold has also been a safe asset when currencies are volatile and there is a sell-off in core currencies, the USD and/or JPY for example. Whatever view one has on the asset, Gold is seen as a store of value by many investors. In January 2020, having decided that we wanted to allocate to Gold into our portfolios, we did so in early February 2020. Our Gold allocation ranges from 2% towards a significant 8% for our active adventurous portfolio. Gold has returned in GBP terms around +25% since that decision.

We will continue to hold Gold as an allocation. We still believe that our underlying thesis for holding Gold remains strong and looks even more compelling: economies continues to slow down, there continues to be heightened volatility in capital markets, especially equity and currency markets. The recession is deep and could get worse before we see improvements. Gold will continue to attract allocations as a safe haven asset.

Our portfolios have performed well against a background of such volatility. In July, our active portfolio Balanced model returned +2%, against a benchmark return of +0.3%, a year to date return of +6.6%, around a 4% out-performance against the benchmark. Our other active portfolios display similar return and out-performance characteristics. We continue to out-perform our peer group considerably.

This performance is pleasing and validates our methodology of being focused and conviction led investors with a patient way of investing in portfolios. We tend not to pay too much attention to short-term market movements and prefer to be inactive when markets are moving in random, volatile directions. Being steady and focused has proved to be positive for the outcomes we seek for our clients. We will continue to remain robust in our views and robust in the implementation of said views. Focused always on the process, not in itself, but for outcomes, real client outcomes.

Email: saftar.sarwar@binarycapital.co.uk

By making an investment, your capital is at risk. The value of your investment depends on market fluctuations outside of our control and you may get back less than you invest. Past performance is no indicator of future performance.