2025: Scalability of Returns

May 2025 marked another important month for global markets as the US-China tariff de-escalation agreement took hold. The 90-day pause, and substantial tariff reductions provided much-needed breathing room for markets that had been under constant trade tensions. Similar positive sentiment surrounds the US-European tariff discussions. However, this reprieve comes with clear conditions and a defined expiration date – so perhaps not the foundation for sustained economic confidence.

Global growth projections remain a challenge. The IMF maintaining its 2.6% forecast for 2025. The divergence between economies continues to widen: US growth moderating to 2.0%, Eurozone struggling at 0.9%, and China’s managed slowdown to 4.2%. These figures reflect not just cyclical challenges but potential deeper structural shifts in the global economic landscape.

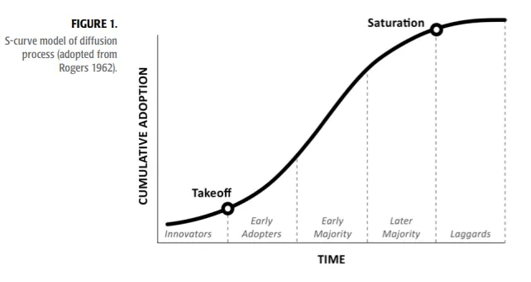

The technology sector experienced notable divergence in May. Companies delivering tangible AI implementation solutions significantly out-performed those still selling AI promises. This marks an important point in the AI adoption curve – where practical application now beginning to overcome theoretical potential.

At Binary Capital, we have maintained our conviction in companies building the infrastructure layer of AI rather than chasing application-level narratives (yet).

The semiconductor space continues to demonstrate pricing power and demand resilience, even as consumer technology spending shows signs of a slowdown. The distinction between essential and discretionary technology spending has never been clearer. The recent positive results from Nvidia made that clearer. Nvidia’s management expressed strong optimism about continued AI demand, despite guiding for $45 billion in next quarter revenue (slightly below some analyst expectations) CEO Jensen Huang highlighted expanding AI applications beyond data centres into enterprise and edge computing. Nvidia should also be able to adapt well into the Chinese AI market.

The regulatory landscape for technology continues to evolve globally, with the EU’s implementation of the AI Act creating compliance hurdles alongside competitive moats for companies with the scale to adapt fast. This regulatory divergence between regions creates both risks and opportunities that require deep research and patient capital to navigate effectively.

Another thematic positioning that is important for us at Binary Capital is Healthcare. Healthcare witnessed accelerated consolidation in May, with M&A activity reaching its highest level since 2023. Digital transformation initiatives gained momentum as healthcare providers seek efficiency gains to offset persistent inflationary pressures in labour costs, as well as utilising the best-in-class technological advancements to bring wearable medtech to a broad market for example. We are excited around the wearable opportunity in healthcare and further AI and robotics integration into core practices.

The convergence of AI and healthcare is moving beyond diagnostic applications into treatment optimisation and drug discovery. Companies at this intersection are demonstrating compelling improved patient outcomes – a rare combination that needs attention. Notably, healthcare spending as a percentage of GDP continues its upward trajectory globally, reinforcing our long-term thesis on the sector’s structural growth. The shift from volume to value-based care models is creating winners and loser.

At Binary Capital, we remain cautiously positive on global markets while acknowledging the narrowing path to sustained growth. Our approach continues to emphasize quality over speculation, patience over reaction, and deep research over immediate market noise.

The current environment rewards conviction and discipline – precisely the investment philosophy we’ve championed through various market cycles. While others chase headlines, we’re focused on identifying the fundamental drivers of long-term value creation in technology, healthcare and biotechnology.

The remainder of 2025 will likely be characterised by heightened volatility as markets digest conflicting economic signals, political narratives and corporate earnings challenges. In such environments, the temptation to react to short-term noise is powerful but often very counterproductive. Our clients benefit from our calm, curious approach to thematic investing – identifying currents before they become waves and maintaining conviction when others will waver.

For May 2025 our portfolio navigated the markets well, benefitting from the change to a positive market sentiment, with returns in the +1.5% to +5% range.

Over three years now many of our strategies are the best performing in their respective DFM peer group categories. This is practical real-world evidence of the work we do every day around returns and performance that we deliver for clients.

The path forward requires navigating complex situational scenarios. For patient capital investors with the right thematic exposures, the investment opportunities currently and into the future remain very compelling.

This is the Binary Advantage.