2026: Radical Uncertainity and Investment Returns

Summary

At Binary Capital, we view 2026 with cautious optimism with intense focus. The global economy is entering a phase of “solid” but slowing growth. Against that background, we continue to see significant opportunities in thematic investing: technology, healthcare, and biotechnology. Volatility will be a constant theme in. 2026. We are prepared. Our long-term focus remains our greatest competitive advantage; it is a genuine identifiable edge. We do not manage money for the next quarter. We manage it for the next decade. This distinction is vital. It allows us to ignore the noise. In 2026, the noise will be louder than ever. We will remain disciplined. We will remain focused on the exponentiality of return outcomes.

The Macro Landscape: Solid but Slowing

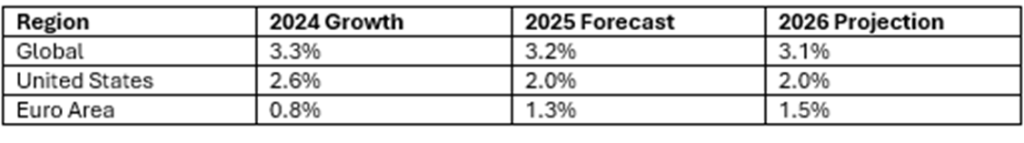

The global economic engine is still running. It is not at full speed. We expect global GDP growth to settle around 3.2% for 2025. This is a slight deceleration from 2024. It is far from a recession. In 2026 we see a “soft landing” as the most likely outcome. The resilience of the US consumer has been remarkable. It continues to defy the doubters. We believe this economic resilience will persist.

Inflation is finally coming under control. It has been a long journey. In the US and Europe, we see it trending toward the 2% target. This is a major milestone. It allows central banks to breathe and gives them flexibility. It also allows them to pivot. The focus is shifting from fighting inflation to supporting growth. This is a fundamental change. We expect the US Federal Reserve to bring the funds rate down to the 3% range by year-end 2026. This is a positive backdrop for risk assets. Lower rates are one of the engines of growth. They reduce the discount rate. For long-duration assets like technology and biotechnology, this is a powerful tailwind.

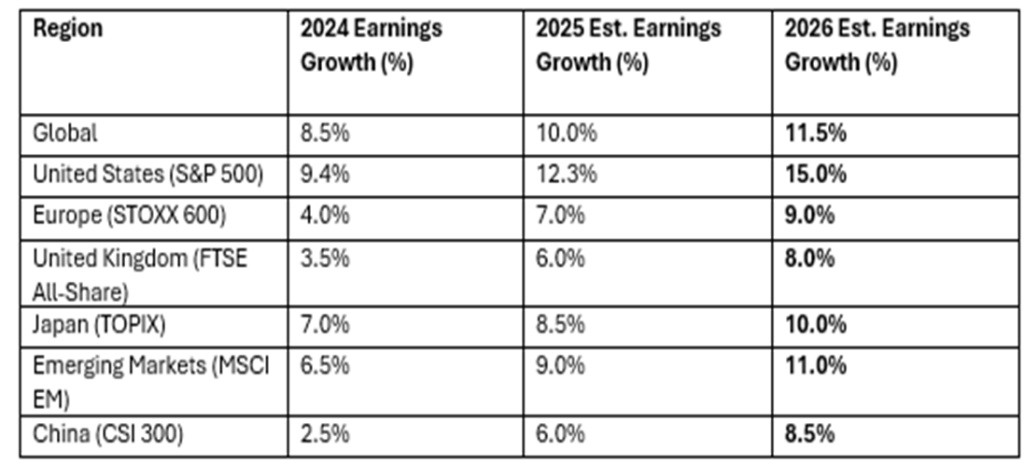

We are seeing a divergence in global growth (see FT data below). The US remains the primary engine for corporate earnings. Europe is struggling to find its footing. China is facing structural headwinds. This divergence creates opportunities. We can be selective. We can go where the growth is, emerging markets for example. We do not have to own the whole market. We only want to own the very selective best parts of it.

Corporate Earnings

The “Animal Spirits” and Radical Uncertainty

January 2025 began with a surge of “animal spirits.” The inauguration of President Trump brought expectations of deregulation and tax cuts. Markets initially cheered. Then came the “known unknowns.”

The emergence of Deepseek, a Chinese AI model, was a pivotal moment. It was a “known unknown” that arrived sooner than expected. It challenged the dominance of the US AI giants. It did so with better efficiency and lower costs. This triggered a sharp reset in technology valuations in late January. Many investors panicked. We did not.

The Jevons Paradox is a concept we discuss often, and it was brought up regularly in 2025. It suggests that improvements in efficiency lead to increases in demand. If AI becomes cheaper, more people will use it. The market for AI will not shrink. It will explode. This expands the total addressable market. US technology exceptionalism is not easily dislodged. The US has the talent. It has the capital. The AI arms race is intensifying. This is positive for long-term growth. We are looking for the winners. We are looking for companies that turn efficiency into earnings.

We see a shift in the AI narrative. The focus is moving from “training” to “inference.” It is moving from building models to using them. This is where the real value will be created. We are positioned for this shift. We are looking for applications that will change how we live and work. This is the exponentiality of outcome we regularly explore.

Trade Wars and Tariffs

We must address the major economic issue of 2025. Tariffs are back. The new US administration is moving quickly. Trade imbalances are being targeted. This will create friction. In the short term, tariffs are inflationary. They disrupt supply chains. They increase costs for consumers. They create “trade wars” that hurt global GDP. This is the “radical uncertainty” we must navigate. However, tariffs may also force a domestic manufacturing renaissance in the US. They may lead to “reshoring.” This could strengthen the US economy in the long run.

We are monitoring the rhetoric closely. We are also monitoring the reality. Often, they are different. We will not make knee-jerk reactions. We look at the broader picture. We look at the data. If a company can pass on higher costs, it will survive. If it cannot, it will struggle. This is where fundamental analysis matters. We are digging deep into analysis of the strategies we own. We want to know where the risks are. Flexibility and pragmatism is a key attribute in 2026. Companies that can pivot will win. Those that are rigid will lose.

Sector Focus: Where the Growth Lies

We remain high-conviction investors. We do not chase every trend. We focus on secular shifts that last decades.

Professor Hendrik Bessembinder’s research (looking at global stockmarket returns between 1990 and 2018) reveals a startling truth: most stocks underperform cash. His study of US markets since 1926 shows that just 4% of companies generated all net wealth. This “asymmetry” means market returns are driven by a tiny elite of “super-stocks,” while the majority fail.

At Binary Capital, we embrace this thinking. In many of our strategies we do not seek the “average” market return. Instead, we focus on identifying those rare, high-conviction strategies with exponential growth potential. By concentrating on secular themes like technology and biotechnology, we aim to capture these asymmetrical winners, ensuring our portfolios are positioned where real wealth is created.

• Technology: We look for companies with “asymmetrical” return profiles. We want limited downside and unlimited upside. We find it in companies with strong moats and scalable business models. Software remains a favorite. It has high margins. It has recurring revenue. It is the backbone of the modern economy.

• Healthcare: Aging demographics are a global reality. This is a secular trend. We look for innovation in delivery. We look for companies that can lower costs while improving outcomes. Value-based care is a key theme. We also like medical devices. They are essential. They are difficult to replicate.

• Biotechnology: We are in a golden age of discovery. Genomic medicine is no longer science fiction. It is happening now. We are seeing cures for diseases that were once death sentences. This is the ultimate exponential outcome. The risks are high. The rewards are even higher. We manage this risk through deep research. We bet on platforms.

• Energy Transition: The world is moving toward a cleaner future. This is a massive capital expenditure cycle. We look for the “picks and shovels” of this transition. We look for the companies that provide the infrastructure. This is a long-term play. It requires patience. We have plenty of it.

Earnings growth for the S&P 500 is projected at 12% for 2026. Technology and Healthcare are expected to lead the way. We want to be where the earnings are.

The Binary Capital Approach

Our investment philosophy is built on three pillars. We do not deviate from them.

1. Diversification: We do not put all our eggs in one basket. Ever.

2. International Focus: We prefer US growth. We also look for value in international markets.

3. The Three-Pillar Asset Allocation Approach (in many cases):

• Fixed Income: For stability and yield.

• Equities: For long-term capital appreciation.

• Liquid Alternatives: To provide protection and upside growth when markets get volatile, especially when they face drawdowns.

Our liquid alternatives acted as a vital hedge during the January volatility. When equities were selling off, our alternatives were holding steady. This is the power of a three-pillar approach. It provides a smoother ride. It allowed our CORE strategies to deliver top-decile returns. We are proud of this performance. As we start 2026, we are not complacent.

We take risks for rewards. That is the nature of investing. We manage those risks with discipline. We use sophisticated tools to monitor our exposure. We are constantly stress-testing our portfolios. This preparation allows us to stay calm when others are panicking. It allows us to be buyers when others are sellers. This is how we generate asymmetrical returns. We are not just looking for growth. We are looking for long-term persistent growth. We are looking for growth protected by a large margin of safety.

Interest Rate Path

The era of “higher for longer” is ending. We are moving toward a “neutral” rate environment. This transition is rarely a straight line. Lower rates support valuations. They reduce the cost of capital for growth companies. This is the “oxygen” that many technology and biotech companies need to thrive.

Conclusion: Patient and Positive

Investing is not about timing the market. It is about duration in the market. We see investments in years, not weeks. This is our identifiable ‘edge’ and a true ‘alpha driver’

2026 will be a year of radical uncertainty. The geopolitical landscape is shifting. The technological landscape is shifting. This could be overwhelming. For the long-term investor, it is an opportunity. Uncertainty creates mispricing. Mispricing creates opportunity. We are here to capture it.

We remain patient. We remain positive. We stick to our process. We do not let emotions drive our decisions. We rely on data. We rely on logic. We rely on our principles. These principles have served us well. They will serve us well in 2026.

In portfolio terms, we had a very positive year in 2025 with returns ranging from +9% to +18% in the more adventurous investment strategies. These are typically in the top 10% of the peer group, and continue the good work of previous years. Whilst returns are never in a straight line, there is no reason why with fortitude, focus and flexibility we cannot produce positive returns in 2026. The Binary investment philosophy is the way to always focus the minds.

Compelling reasons for growth exist today. They are as relevant now as they have ever been, perhaps even more so than before. The world is evolving. It is changing. We are embracing that change. We are positioning our portfolios for the future. We are ready for the journey. The best opportunities have yet to appear, yet to come